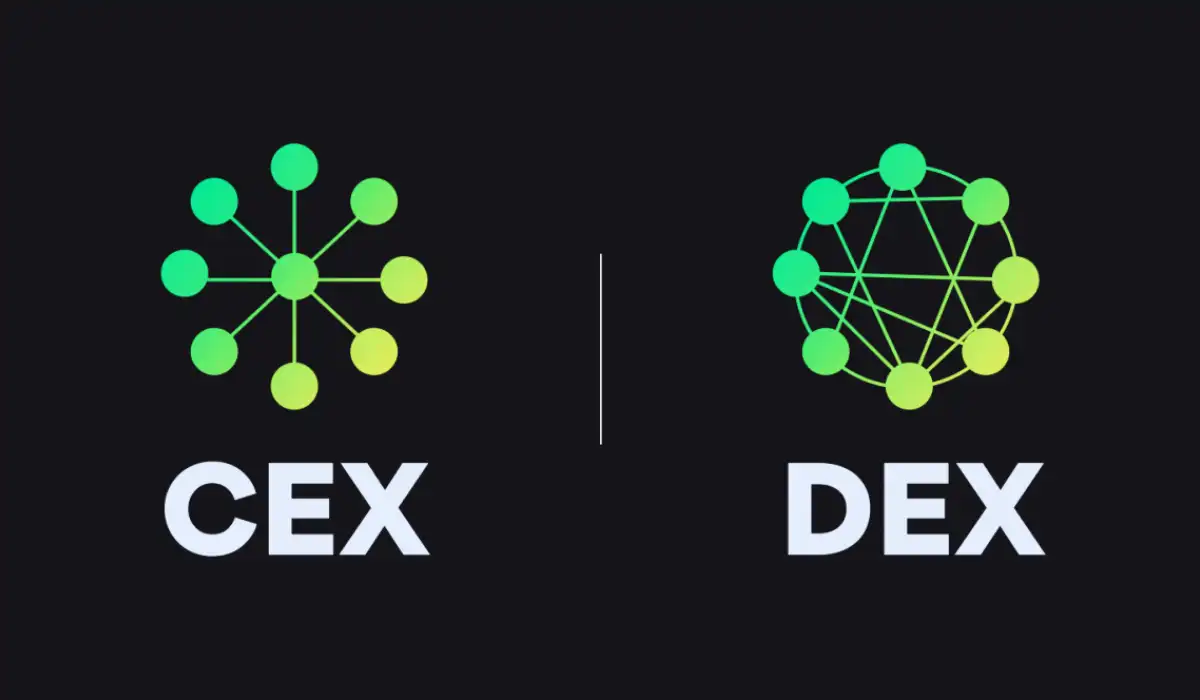

Cryptocurrency has gained widespread popularity over the past few years. There are many reasons behind the rising growth of the crypto industry. It is impossible to navigate through the crypto sphere without crypto exchanges. Exchanges form the backbone of the crypto industry by accelerating transactions. The two primary crypto exchanges include centralized and decentralized exchanges. Selecting a crypto exchange is a crucial decision that investors have to take as it can influence the entire trading experience.

What are centralized exchanges (CEX)?

Centralized exchanges accelerate the trading process by acting as intermediaries between the buyers and sellers. These types of exchanges provide a user-friendly platform for trading cryptocurrency. They function somewhat similarly to traditional stock markets. Centralized exchanges are controlled by a single authority that controls the overall transaction process and the funds. Some of the well-known centralized exchanges include Coinbase, Binance, and Kraken.

To further understand the nature of centralized exchanges let us go through the advantages and limitations of these exchanges.

Advantages

Provides a user-friendly interface: One of the standing benefits of CEXs is that these platforms offer beginner-friendly interfaces. This key feature helps novel and existing investors navigate through the platform and easily carry out the trading process.

Offers high liquidity: Centralized exchanges generally offer higher trading volumes and liquidity. High liquidity is essential for a smooth trading experience.

Enables faster transactions: As centralized exchanges operate on off-chain systems, they offer much faster transactions.

Limitations

Security threats: Centralized platforms hold the users’ crypto assets in centralized wallets. These wallets are highly vulnerable to cyber security scams and threats leading to the loss of funds.

Regulatory issues: These exchanges also remain vulnerable to regulatory laws and implications that might interrupt the various operations taking place on the platforms.

What are decentralized exchanges (DEX)?

Decentralized exchanges allow buyers and sellers to directly trade with each other without the need for any intermediaries. These exchanges hold the user’s funds using smart contracts instead of using traditional order books. Unlike centralized exchanges that allot the overall control of the transactions to a single entity, decentralized exchanges invite the users to take control of their transnational processes. Some of the most popular decentralized exchanges include Uniswap, Curve, PancakeSwap, and SushiSwap

Let us have a detailed look at the advantages and limitations of decentralized exchanges.

Advantages

Enables user control over private keys and funds: One of the top benefits of decentralized exchanges is that they allow users to have complete control over their private keys and their funds. Users do not have to approach a third party to access their funds instead they can use the funds directly from wallets for trading. This also reduces the risks of cybersecurity threats and scams as the private keys are securely kept under the control of the users.

Global accessibility: Users can trade from anywhere in the world using decentralized platforms without limitations. DEXs eliminate geographical and verification interruptions by ensuring equal access to the users.

Offers privacy and anonymity: Decentralized exchanges do not ask the users to go through any verification procedures like the KYC process. This eliminated the need to disclose any personal information and the users can stay anonymous while trading.

Limitations

Trading options are limited: Even though decentralized supports many cryptocurrencies for trading, they lack many advanced trading features due to technical limitations. This challenge can limit the trading opportunities on the platform.

Offer lower liquidity: Decentralized exchanges offer lower trading volumes and much lower liquidity than centralized exchanges. This makes the platform fail to deliver favorable trading conditions for huge orders.

CEXs or DEXs: What to choose?

Both centralized and decentralized exchanges come with their own pros and cons. Choosing a crypto exchange completely depends on the user’s needs and preferences. Beginners could start their trading journey using centralized exchanges as these platforms provide a beginner-friendly interface that makes the whole trading process much easier for the users. They also contain a virtual library that offers guidance for the crypto industry.

Compared to decentralized exchanges, centralized exchanges provide higher trading volume and liquidity making the platform capable of higher orders. However, these exchanges have higher transaction fees than decentralized platforms. CEXs might impose fees on withdrawals and some cryptocurrencies. Since the centralized exchanges hold the funds of the users, these funds become vulnerable to cyber security threats and attacks.

On the other hand, decentralized exchanges can be considered a better option for users who prefer to control their funds. These exchanges allow the users to take complete control of their transaction process and funds. Users can store their funds in an exchange wallet thus making it less vulnerable to any online threats and scams.

Users who wish to stay anonymous throughout the trading process can also choose to trade on decentralized platforms as they do not ask for any verification process. The transaction fee is also comparatively lower compared to centralized transactions. As compared to CEXs which are supported by regulatory laws, DEXs remain vulnerable to many regulatory laws and implications. This limitation can interrupt the trading process. Another major challenge faced by DEXs is that they offer lower liquidity which can also reduce the trading opportunities on the platform.

Also Read: Cryptocurrency Dogecoin: A Complete Guide to Its Features & Uses

Conclusion

Crypto exchanges lay the foundation of the trading process. Users should consider many factors like security needs, user experience, liquidity, and transaction fees before choosing the trading platform. Even though centralized and decentralized platforms are used for the common purpose of trading, they both have many fundamental differences. Users should consider their needs and other crucial factors that can help them conduct a smooth trading experience.