One Little Way The Tax Code Sucks For Student Loan Borrowers

Joyce Park stashed this in Saving money

Stashed in: Awesome, Personal Finance, Student Loans

To save this post, select a stash from drop-down menu or type in a new one:

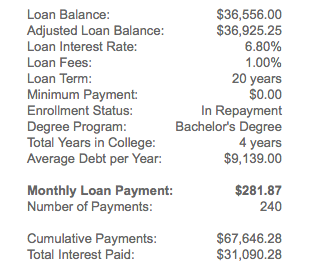

Student loan interest is mostly not deductible... so older people who buy houses get their mortgage deductions at the expense of younger people who invest in their educations.

Also not deductible: credit card interest, car loan interest for cars not tied to business, personal loan interest... In fact, most forms of consumer debt besides loans to buy houses are not deductible:

http://blogs.wsj.com/totalreturn/2015/02/19/the-loan-interest-you-can-and-cant-deduct-on-your-taxes/

9:05 AM Jan 21 2016