I've got student loan debt. Should I be contributing to a 401k? Also, when is student loan debt consolidation a scam? by NPR

Adam Rifkin stashed this in Student Loans

Stashed in: Personal Finance

Whether to fund your 401k while you have student loan debt depends on the situation.

Experts say studies show rising student debt is limiting peoples' career options. They decide against graduate school. Or feel they can't afford lower-paying public service jobs or the risk of starting a new business. That's a problem, because new companies create new jobs.

Chris Costello, CEO of Blooom, a personal finance advice firm targeting lower-net-worth people, says one of the top questions his firm's clients ask goes something like this: "I've got student loan debt. Should I be contributing to my 401(k)?"

Many people think they need to pay off the loans first. But Costello says if your employer matches contributions to a retirement plan, such as a 401(k) or 403(b), it would be crazy not to take advantage of it.

"Please, please do not leave those free dollars on the table," he says.

But after maxing out on the matching contributions, Costello advises paying off the debt with the lowest balance. Some advisers say target the one with the highest interest rate, but he says there are psychological benefits to tackling the smallest balance first.

"It's called the debt snowball method, and it's an easy way to build momentum and mental confidence that you're actually making progress in getting debts paid off," Costello says.

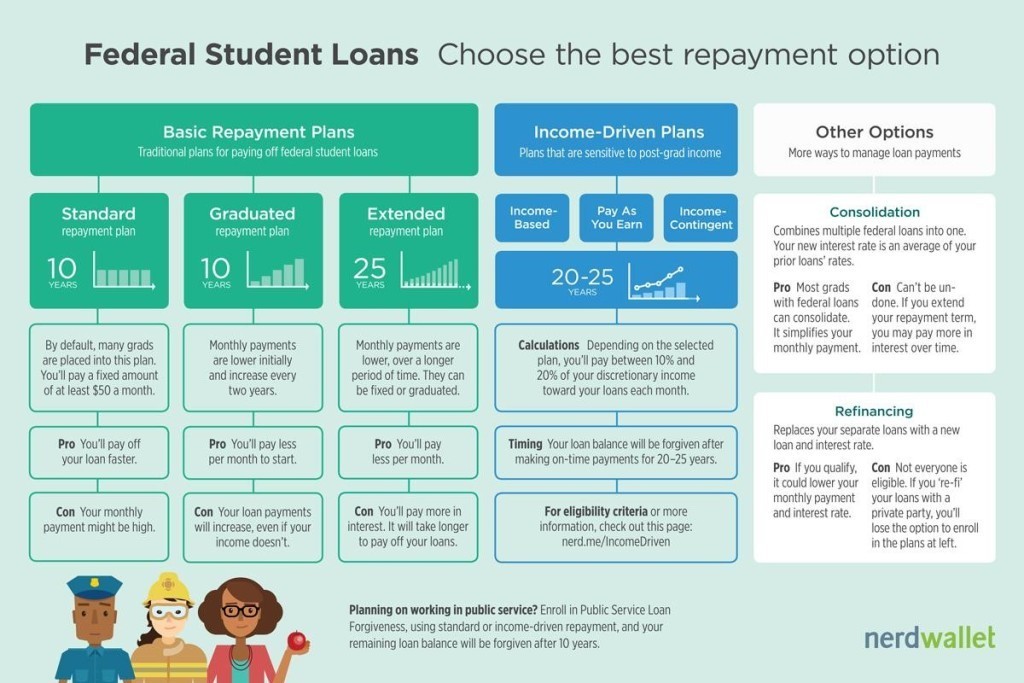

Debt counselors also say graduates with debt should see if they can qualify for loan forgiveness, refinancing or debt consolidation — all while not incurring new debts. In other words, he says, live below your means.

Student Loan Debt consolidation can be a real thing; it can also be a scam.

- It's a real thing when you consolidate your federal student loans into a single direct loan, held by the Education Department. This can simplify your payments and make you eligible for more repayment programs.

- It's a real thing also when you consolidate your private student loans by taking out a new loan from a reputable bank. This may or may not save money, if the bank offers a lower interest rate on the new loan. It also may simplify payments.

- It's a scam, says the National Consumer Law Center in a 2013 report, for companies to charge high upfront fees to "help" you consolidate your student loans. Or to claim any government affiliation, such as that they are an "approved servicer." Or to advertise that they offer exclusive access to plans that are really government repayment plans — such as income-based repayment, which is available free to anyone.

- It may be a scam when someone wants you to consolidate your federal loans into a new private loan. Private loans can, in limited cases, be cheaper. But federal loans have more protections for borrowers.

6:35 PM Mar 02 2016