Can The Best Financial Tips Fit On An Index Card?

J Thoendell stashed this in Personal Finance

Source: http://www.npr.org/sections/alltechconsi...

A couple of years ago, University of Chicago professor Harold Pollack did an online video chat with personal finance writer Helaine Olen. The topic was how regular people get steered into bad investments by financial advisers.

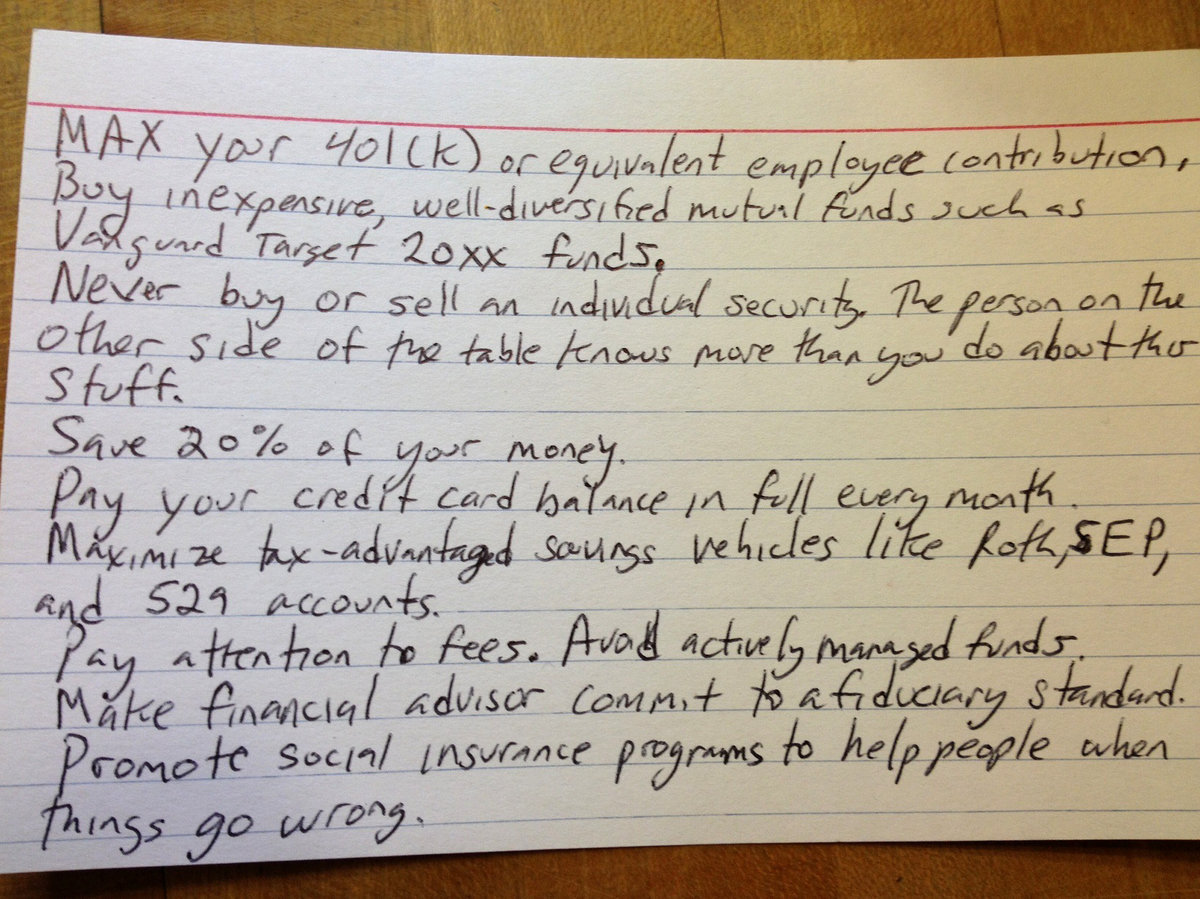

Pollack said that the best personal finance advice "can fit on a 3-by-5 index card, and is available for free in the library — so if you're paying someone for advice, almost by definition, you're probably getting the wrong advice, because the correct advice is so straightforward."

Stashed in: Advice, Awesome, Manifestos, Investing, BuckTales, Personal Finance, Retirement, University of Chicago, Index Cards

And this actually gets at what many economists say is the reality with financial advice: Most of it is pretty simple.

The rules on Pollack's index card start with saving 10 to 20 percent of your income, maxing out your 401(k), not buying or selling individual stocks.

But there also are more subtle points of advice — including whom you should bring on to help advise you.

"I'm struck by the number of my friends and relatives who believe that their financial adviser is free, and say things — 'Oh, the funds pay for that,' " Pollack says. "I don't know about you, but I generally don't work for free. So you want to understand, how is this person being paid?"

Rule No. 6 on the index card is to make your financial adviser commit to the Fiduciary Standard — meaning that your interests come first.

But the regulations around that can be mushy. Some economists say an easier approach is to use what's called a "fee-only" adviser, who can't take commissions for steering you into overpriced mutual funds. If you have an adviser, Pollack and Olen say you need to talk about this stuff.

It's really hard to be poor.

See Pollack's amazing interview on how being poor changes the way people think for more on that.

But the lesson here is that once you have an income that you can live off of and save a little bit besides, managing your finances shouldn't be all that hard. The people making it complicated are often trying to make money off of you.

Source:

The interview, part 1:

We discuss why divorce is bad for your financial health, and why trusting financial advisors is generally a bad idea, even if one assumes that this person is above ethical reproach. We note the false hopes placed in personal financial skills to offset stagnant wages for millions of Americans. Finally, we observe that Suze Orman isn’t one of the world’s greatest financial advisors, but she has found one of the world’s greatest sales gigs. At least Orman is less predatory than many of the other finance gurus.

Source and also part 2:

Harold Pollack's book with Helaine Olen, based on the card, may be found here and here.

More tips that fit on an index card:

http://pandawhale.com/post/69979/how-to-spend-less-so-you-can-afford-to-save-more

http://pandawhale.com/post/67917/one-sentence-financial-rules

8:01 PM Jan 08 2016